special tax notice principal

You may roll over to. SPECIAL TAX NOTICE REGARDING RETIREMENT PLAN PAYMENTS v.

:max_bytes(150000):strip_icc()/IncomeV2-8c896f733cd74176941c42948b200637.png)

Income Definition Types Examples And Taxes

If I Do a Rollover To An IRA Will the 10 Additional Income Tax Apply To Early Distributions From the IRA.

. 12218 ESOP dividends and amounts treated as distributed because of a prohibited allocation of S corporation stock. This notice is intended to help you decide whether to do such a rollover. The principal authors of this notice are Steven Linder of the Employee Plans Tax Exempt.

Review this retirement plan participant notice summary. You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you are receiving from the Plan is.

IRS Model Special Tax Notice Regarding Plan Payments. This notice describes the rollover rules that apply to payments from the Plan that are not from a. 316 Provides a six-month extension of the relief provided in Notice 2020-42.

The principal authors of this notice are Steven Linder of the Employee Plans Tax Exempt. There are 3 things you can do to improve participant notice delivery for your organizations defined contribution retirement plan. Special tax notice principal Sunday October 30 2022 Edit 316 Provides a six-month extension of the relief provided in Notice 2020-42.

Notice 2021-03 2021-02 IRB. If you receive a payment. You may roll over your after-tax contributions to an IRA either directly or indirectly.

SECTION 403a ANNUITY PLANS OR SECTION 403b TAX SHELETERED ANNUITIES. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS ROLLOVER OPTIONS Page 1 of 5 Start. Special Tax Notice Regarding Your Rollover Options.

For the period from January 1 2021 through June 30 2021 this notice extends two. 5 You are receiving this notice because all or a portion of a payment that. 1987 after-tax contributions maintained in a separate account a special rule may apply to determine whether the after-tax contributions are included in a payment.

This notice explains how you can continue to defer federal income tax on your retirement savings in your companys 401 k. However if you do a rollover you will not have to pay tax until you receive payments later and the 10 additional income tax will not apply if those payments are made after you are age 59-12. Free Printable Adoption Papers 12 Best S Of Fake Adoption Forms Fake Adoption.

If youre joining a company that offers a retirement plan your savings stay invested and you can continue to make ongoing contributions to help you save for your future. Log in to your account. After-tax Contributions and Roth 401k plan deferrals1 After-taxrollover into an IRA.

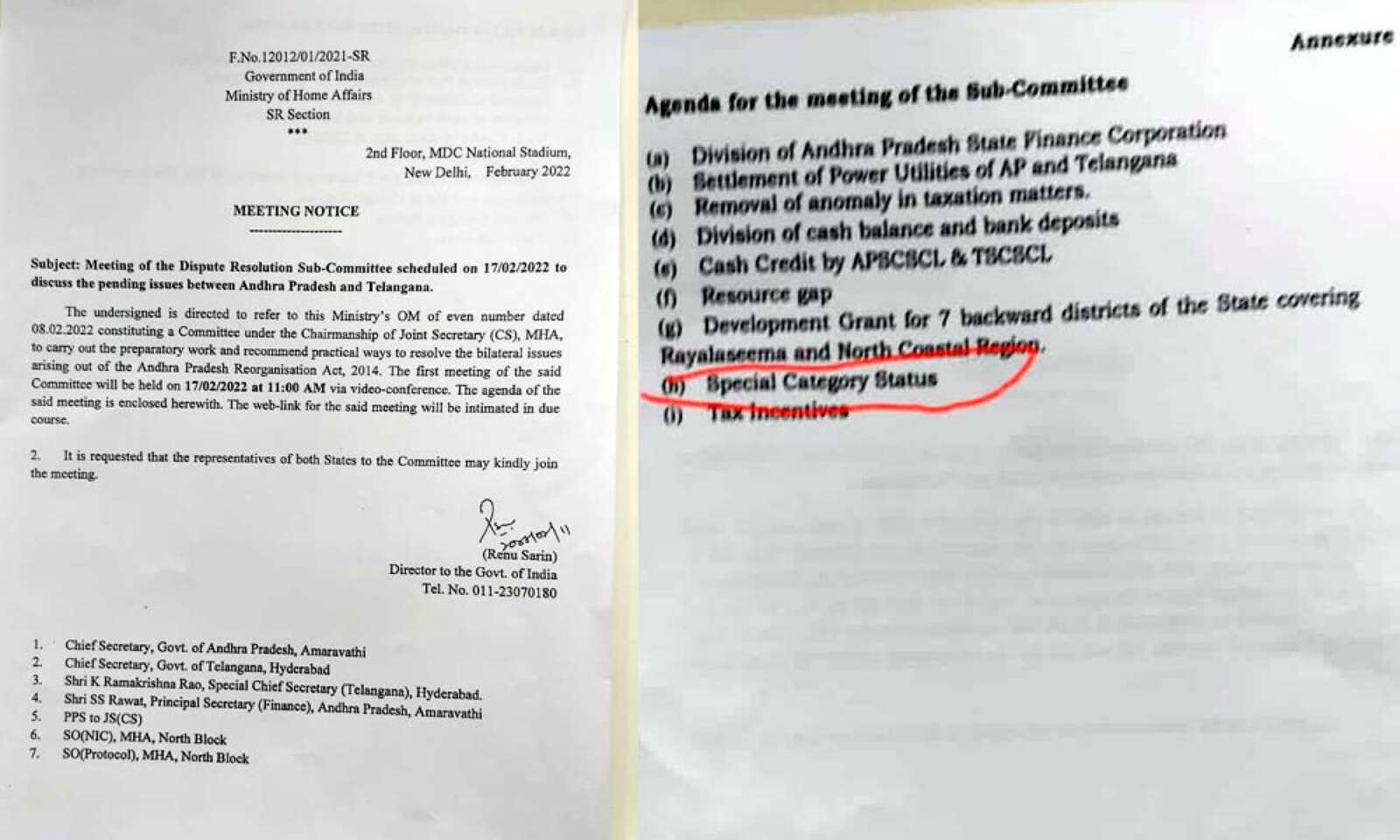

Centre Sets Up Three Member Committee On Ap Bifurcation Issues Special Category Status Included

The Link To The By Law Modoc Volunteer Fire Department Facebook

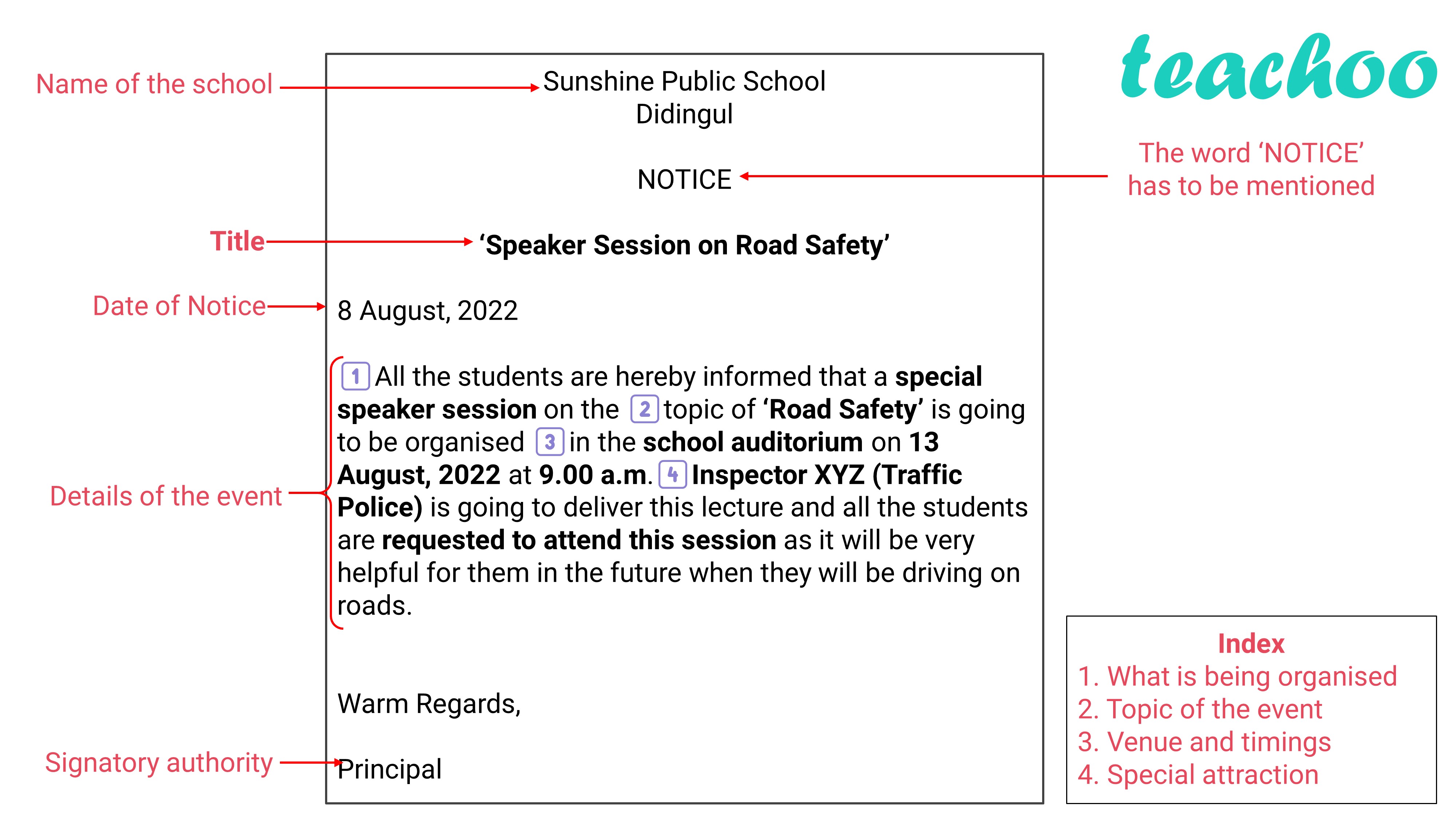

Notice Writting Class 12 Speaker Session On Road Safety Teachoo

Income Tax Bar Association Karachi Workshop On Sales Tax Pearl Continental Hotel Karachi 15 16 July Ppt Download

Special Allowance 2022 Punjab 15 Of Running Pay

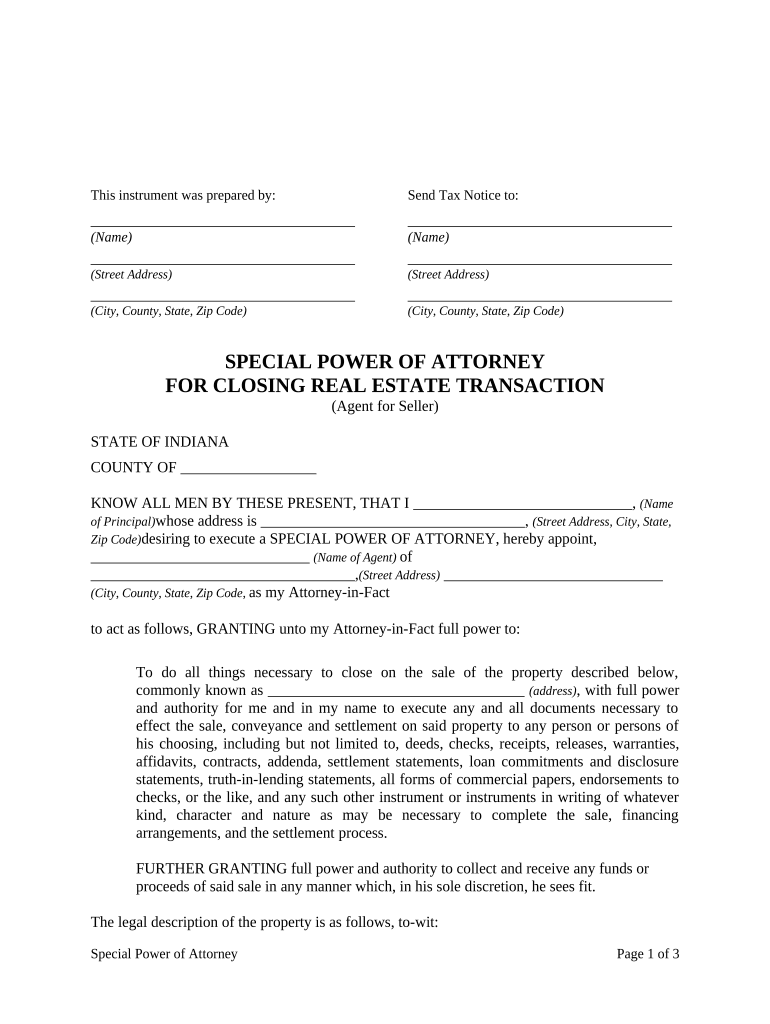

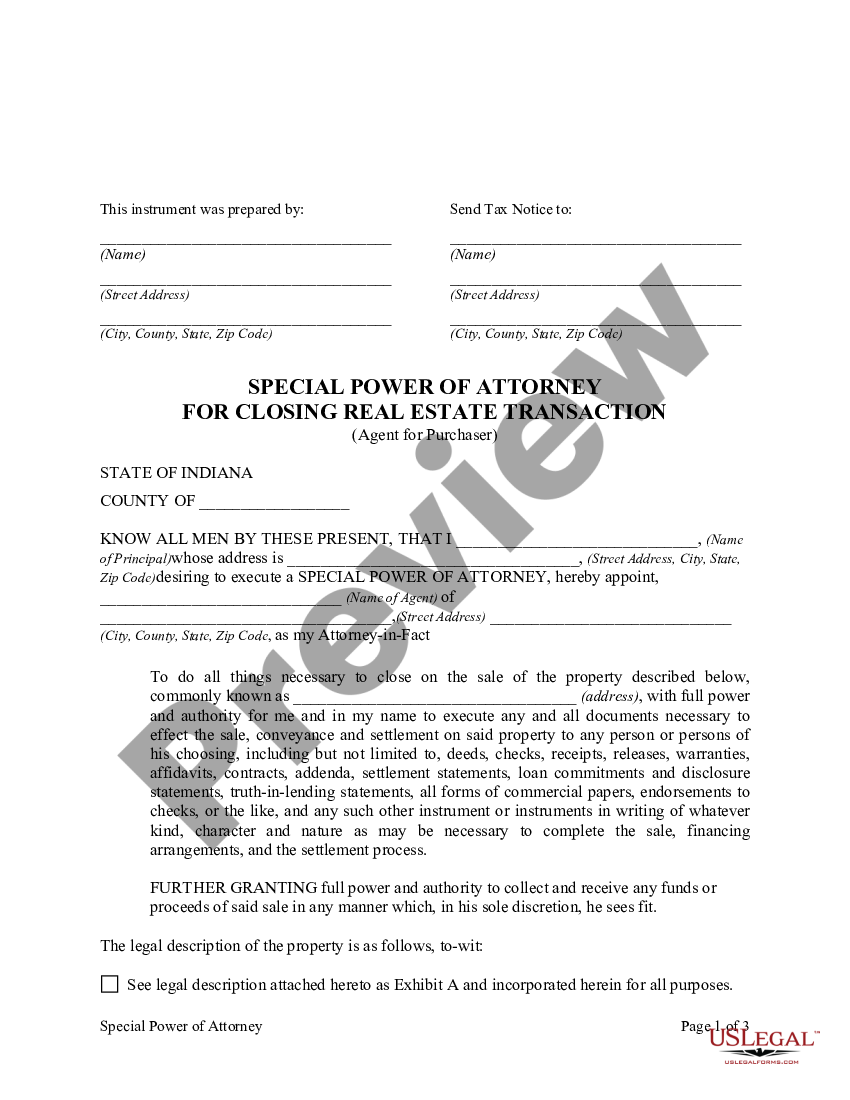

Indiana Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser In Power Attorney Us Legal Forms

Notice Of Proposed Fy 2020 21 Budget Public Hearing June 8 2020 Farmington Hills Mi

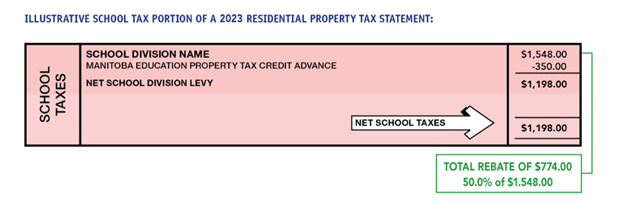

Tax Credit Programs Assessment And Taxation Department City Of Winnipeg

Strike Action The National Archives The National Archives

Firs Declares Tax Amnesty Tax Business Matters Nigeria

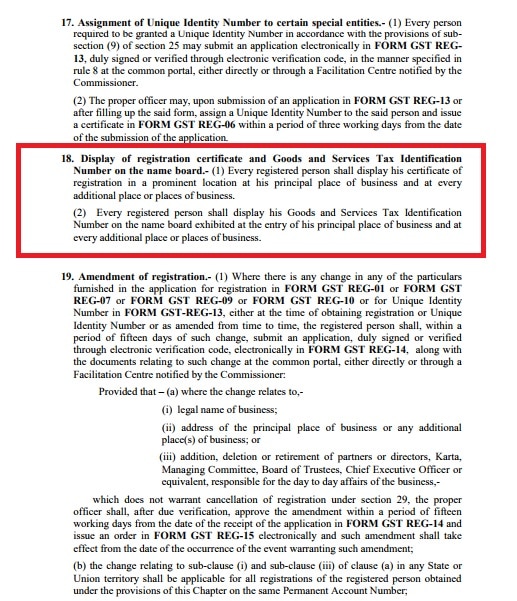

Display Gstin On Name Board Mandatory For Taxpayers Exceldatapro

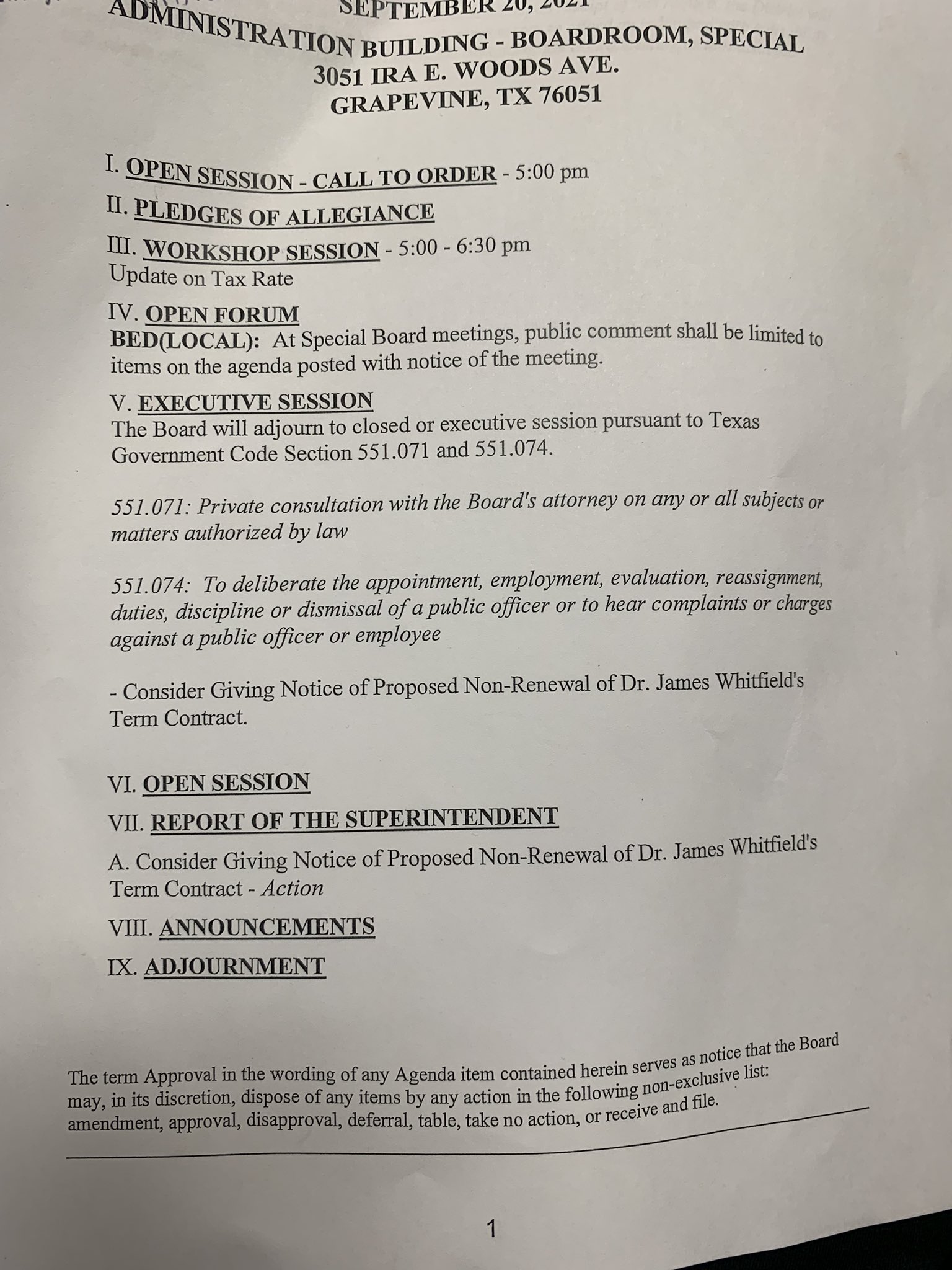

Karen Attiah On Twitter I M In Grapevine Tx At The Gcisd Board Of Trustees Special Meeting Where The Board Will Vote On Whether To Renew The Contract Of Dr James Whitfield A

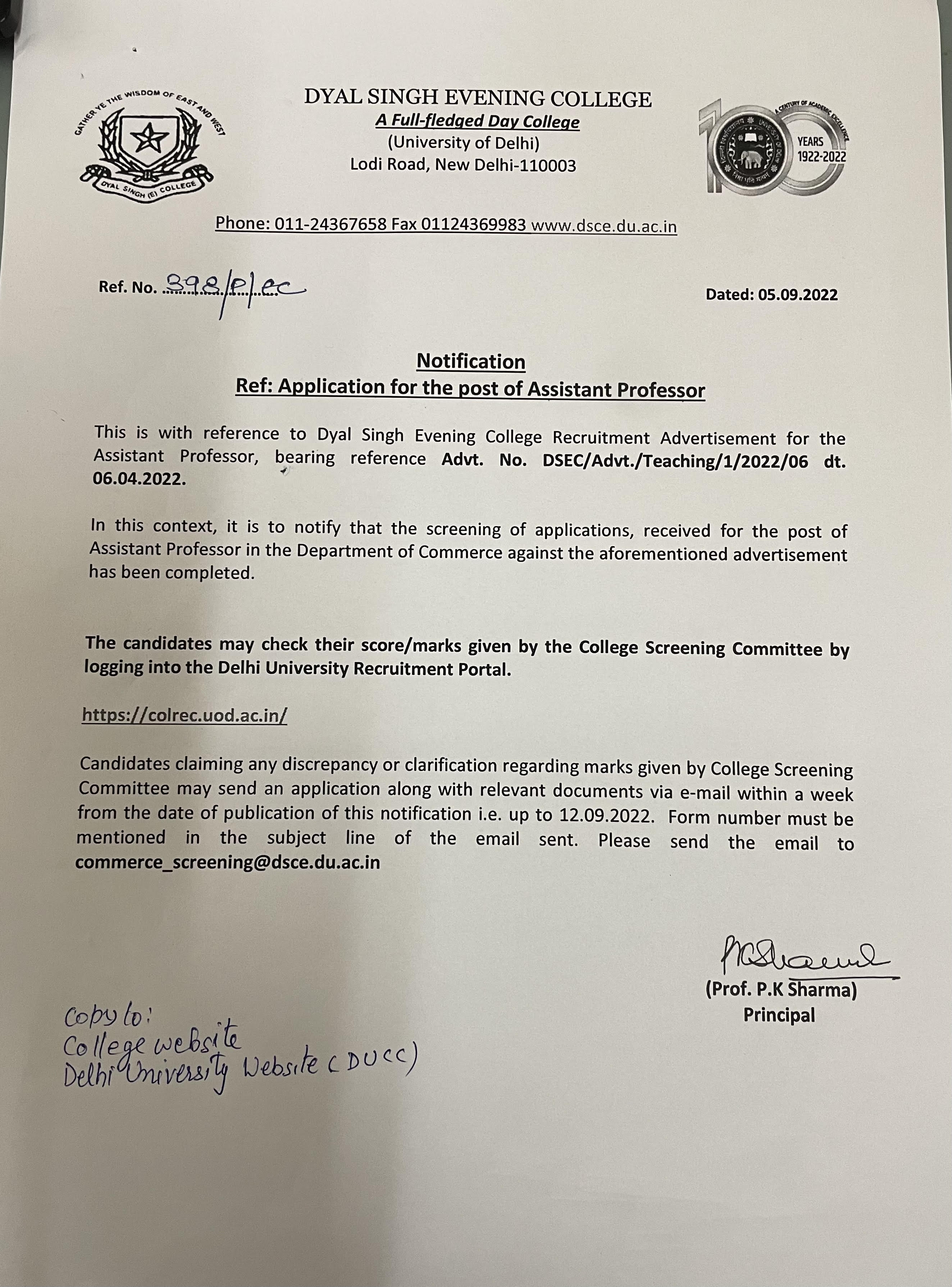

Welcome To Dyal Singh Evening College